InvestDEFY Active and Liquid Futures Continuous Contracts for BTC and ETH

Introduction

InvestDEFY’s continuous futures contract metrics are synthesized time series that represent the prices of futures contracts over time without the discontinuities that arise from contract expirations. Since individual futures contracts have finite lifespans and expire periodically (weekly, monthly, quarterly), the continuous futures contract creates a seamless price series by "rolling" from one contract to the next. This process involves several key steps and methodologies to ensure that the transition from one contract to another is as smooth and consistent as possible. The aim is to provide a long-term view of the futures prices, which is particularly useful for technical analysis, backtesting trading strategies, and economic research.

Nuances in BTC and ETH Futures

BTC and ETH futures trading away from the CME on centralized exchanges exhibit unique futures roll behaviors. On the CME, institutional participation, notably from the ProShares BTC futures-based ETF with $2.1 billion AUM, influences a predictable roll pattern with open interest steadily declining from one week out through expiry. In contrast, centralized platforms like Deribit show non-traditional roll paths due to extensive delta hedging by market makers and limited traditional finance directional exposure (graph below illustrates the increase in open interest heading into expiry as evidenced by orange circles).

InvestDEFY Analytics

Roll Methodology:

InvestDEFY employs the Calendar roll methodology for their Active and Liquid roll continuous futures contract metrics.

Liquid Continuous Futures

Rolls underlying futures contracts for default tenors (1W, 1M, 3M) ahead of maturity.

Selects the most liquid and closest maturity futures contract.

Ensures non-overlapping contracts for each default expiry.

Roll Schedule:

1W: Rolls on expiry.

1M: Rolls one week before maturity.

3M: Rolls one month and one week before maturity.

All rolls occur at 8:00 am UTC.

Active Continuous Futures Metrics

Expiry-Based Roll Methodology:

Rolls underlying futures contracts for default tenors (1W, 1M, 3M) upon expiry

Selects the most liquid and closest maturity futures contract.

Active Roll Characteristics:

Last week of each quarter: Same underlying futures contract for 1W, 1M, and 3M tenors.

Last week of each month: Same underlying futures contract for 1W and 3M tenors.

Last month of each quarter: Same underlying futures contract for 1M and 3M tenors.

All rolls occur at 8:00 am UTC.

Liquidity Analysis

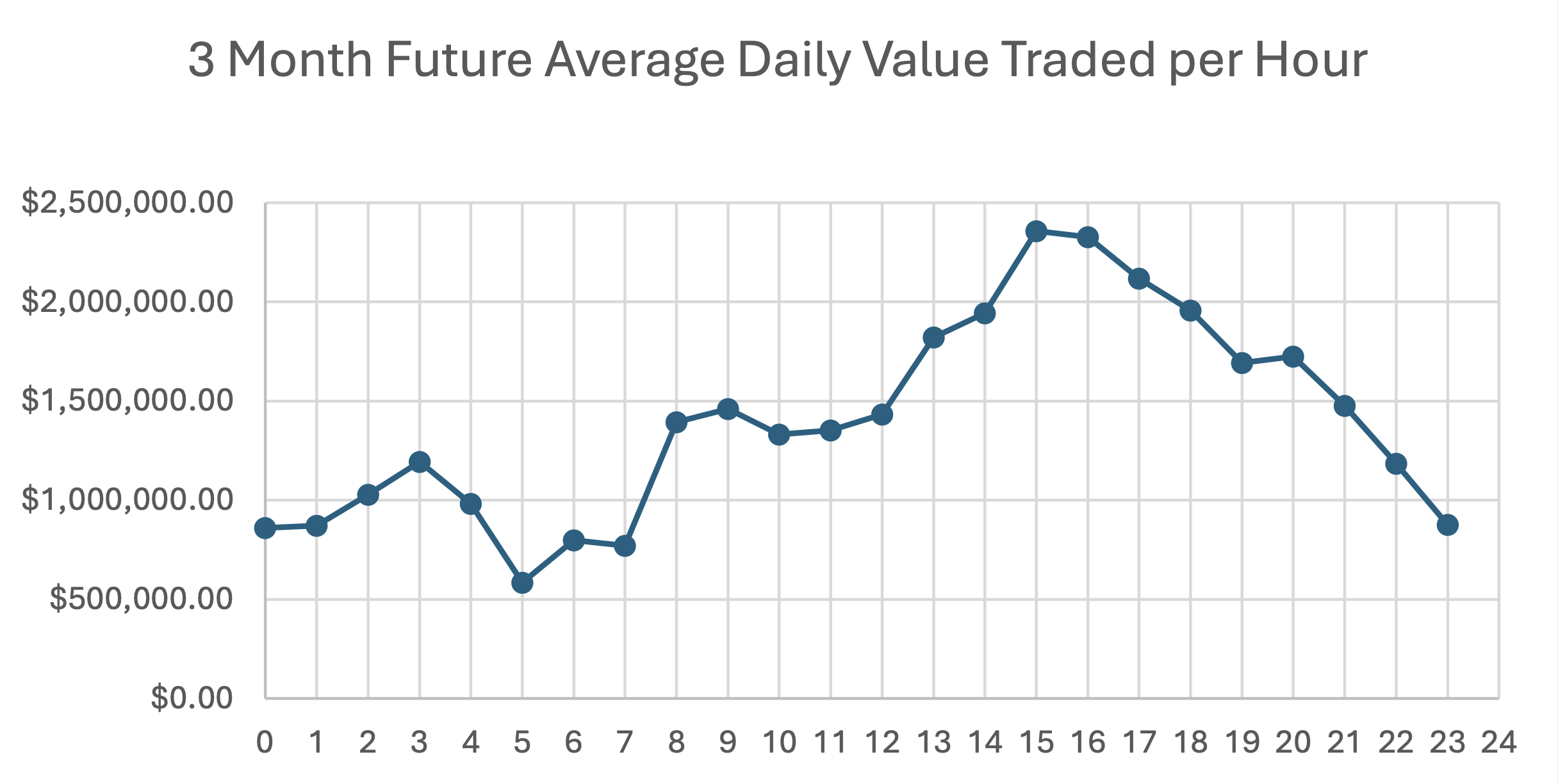

The following graphs visualize the average total value traded on Deribit per hourly bar since January 1, 2023, to date excluding weekends to avoid skewed averages due to low liquidity.

InvestDEFY Analytics